You’ll need a plan of execution, and a willingness to make serious changes so that you can start stashing away some cash, either for a rainy day where your car breaks down, you lose your job, and your house burns to the ground, or for a future free from wage slavery, where you can relax, retire, and no longer break your back for someone else’s profit. Whether you’re making the bare minimum or looking for ways to further pad your plush account, these 17 money-saving tips will work for anyone trying to save a buck.

Budget

The first step is knowing exactly where every cent you earn is going. Most of us lose money by drips and drabs that fall through the cracks. Learn exactly how much you need to spend on everything in your life. By knowing where there are splits in the damn, you can plug them up to keep your cash reservoir safe.

Move Somewhere Cheap

Living in an expensive place is the first way to throw money away. Find cities off the beaten path where a dollar buys more housing, more food, and more of everything. That will give you more breathing room without needing to earn more or take on another job. Also find areas with progressive social programs that help with medical bills and provide wage-based assistance. A penny saved…

Follow The Money

Along with going where it’s cheap to live, find places with high minimum wage. Washington state currently has the highest minimum wage in the United States, floating at $11 or so. While that won’t get you far in Seattle and Tacoma, head to the other towns where it’s far less expensive to live and you’ll get more scratch in your pocket, plus pay less for stuff. Make sure you find a balance between what you make and what you spend on just living. Low rents and high minimum wage are the places to go.

Don’t Expand Your Family

A partner that splits the bills with you is great, but spending money on romance, on children, on weddings, and the other trappings of family life will drain your savings to nothing. Being alone is cheap, and children are a complete financial black hole for 20+ years. Do everything you can to stop burdening the overpopulated world and save money at the same time. There’s no downside.

Payoff Debt ASAP

As time passes, debt accrues interest, which makes your debt bigger. If you’re only paying the minimum on your student loans, your credit cards, or any other debt you have, you’re probably not even covering the amount of the interest, which means your debt is never actually going down. They’re just taking free money off of you. Banks love this trap, because they can make thousands of dollars on a small loan by keeping you in debt. The sooner you’re out of debt – all debt – the sooner you can actually keep your own money. Make this the biggest priority in your life. Once the debt is gone, then you can save.

Swallow Your Pride

Refusing to accept EBT or other food assistance programs, take charity that is offered, or go onto medicaid because you think it makes you look bad is a waste. That’s nothing more than paying hard-earned money to keep your ego happy. If you qualify for any kind of assistance programs, you should be taking advantage of them. Hell, if you can legally and safely dumpster dive, that’s not a bad idea either. Lots of food for no cost.

Avoid Automobiles

Cars are costly. Gas, insurance, maintenance, and repairs will kill your savings. Use public transit as much as possible, or get yourself a good commuter bike and you can cut a gym membership out of your budget while saving.

Save Any Unexpected Cash

If you get an inheritance or a tax refund or even $20 laying on the ground, save it. That money wasn’t part of your budget which means it’s pure profit. Put that into an account with a good interest rate and now interest is working for you, instead of bleeding you out.

Cook It Yourself

Learn a few simple recipes that you can throw together quickly and use those instead of processed food. It’s always cheaper to make something yourself than to buy it pre-made. A lump of dough, a little pressing, some tomatoes and cheese, and you’ve created a pizza for dollars less than you could buy a frozen one. Learning when local stores have sales on meat and produce will help you also.

Give Your Kids Away

Ha! We don’t mean sell them into slavery, though that would certainly make you good money and save on child expenses. By this we mean give your kids to family or friends for care instead of paying for costly daycare or babysitters. Go ahead and impose a little bit, or consider having one partner stay home while the other works. In a house with two minimum-wage incomes, childcare usually wipes out the money made by one whole person. Having one of you switch to part-time, or learning a job you can do from home might be and even better solution.

Seek Out Employer Programs

Minimum wage is often paid by large organizations that have employee 401(k) or stock purchase options. Find out how you can use your job to make you even more money down the road. Everyone wins in that situation. Use those to the absolute maximum.

Find a Good Bank

How you save money is as important as if you save money. Find a bank with high interest return on their savings accounts and CDs, then use them. High interest rates kill you if you’re in debt, but save you thousands if you’re using them to help you along.

Get a Change Jar

We lose much of our money on small, wasteful purchases, which means we should save money the same way. Literal nickles and dimes add up if you put them somewhere. Then just drop them off at the bank for bills or automatic credit to your account.

Sell, Sell, Sell

If you don’t need it, sell it. Put it on eBay with a shipping cost and see if anyone buys it. The crap people will pay good money to get is insane. Craigslist is also good for this, if you have bigger items (and don’t mind people knowing where you live).

Upgrade Yourself

If you have a minimum wage job, always be looking for something a little bit better. Going up one tiny rung means hundreds of dollars. A penny more each hour works out to about $21 a year. Up that to a dime more every hour, and you’ve got an extra $210 in your pocket. Any job that pays more, however slight, is a step up.

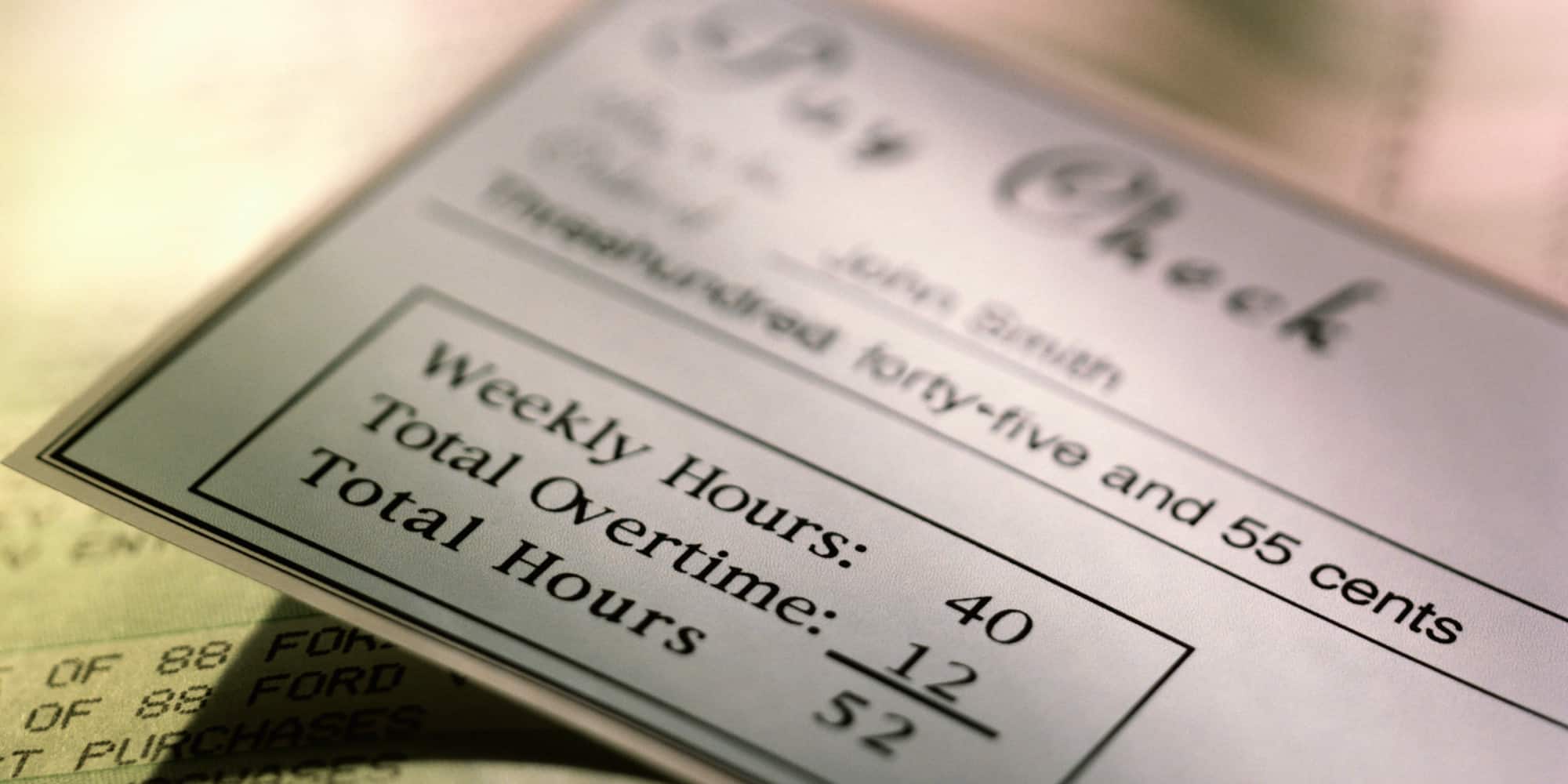

Pay Yourself First

Before you ever see your paycheck, figure out how much you can save and have your bank automatically deduct it. If you never see it, you never miss it and never spend it. Plus it will quietly earn and earn and earn in the background.

Limit Your Luxuries

We’re addicted to entertainment, and that’s ok, but find ways to get more bang for each buck. You probably don’t need cable and an internet connection. You also don’t need a brand new phone complete with long-term contract. Use your WiFi for all your entertainment and get a pre-paid phone. Or you can go with Ting, a cell provider that only charges you for what you use without an expensive contract. They use the same gear as the big ones, they just don’t make you pay for it.